By Editor Morten B. Reitoft

Highcon was founded in 2009 by Aviv Ratzman and Michael Zimmer. Both had a background with HP Indigo and as the digital transformation took place in front of their eyes, an idea was born - or at least that is my guess! The fact is that Highcon (currently under maintenance), for the first time, was presented to the public at drupa 2012, and though I don't remember their drupa presence from 2012, I do clearly remember Highcon from the 2016 edition, where they had a fantastic stand next to Landa. At the booth, beautiful women were dressed up with paper dresses cut to precession with the Euclid laser cutter, and between the halls, you could see beautiful filigree hanging from the ceilings. An icon from Highcon was also a laser-cut Einstein face, a gigantic book where every page revealed the most beautiful examples of what laser cutting could do - a fantastic showcase of the technology!

This was beyond COOL. The three women posed during drupa to show their dresses made out of paper. The book on the first photo is amazing, and so is the Einstein cut out - and, of course, the beautiful filigree in the halls of drupa. Highcon was flying - at least how it looked from the outside!

Aviv Ratzman and Michael Zimmer stopped with Highcon in 2020, and shortly after, in November 2020, Highcon went public on the Tel Aviv Stock Exchange. Despite generating losses close to 100 million USD for over ten years, the IPO was surprisingly good. The two majority of investors are Landa Ventures (Benny Landa) and Jerusalem Venture Partners (JVP) (Erel Margalit), with 43% of the shares. The IPO gave Highcon a market value of $190 million - and for perspective, the annual revenue in 2022 was a little less than $17 million, and for June 2022 and 2023 comparison, the numbers are respectively $9,264,000 vs. 3,352,000 - a dramatic decrease in revenue for Highcon.

Former GM of HP Indigo, Alon Bar-Shany, became, in January 2021, Chairman of the Board. Most people in the industry saw the IPO as a renewed confidence in Highcon and its technology - but an article from Israeli tech media CTECH on September 3rd, 2023, described how the money from the IPO and valuation of Highcon quickly decreased. The value of Highcon since its IPO has reduced by 94%, and the free cash to less than 6 million USD, which can only be described as a nightmare scenario for Highcon, and something has to be done - NOW!

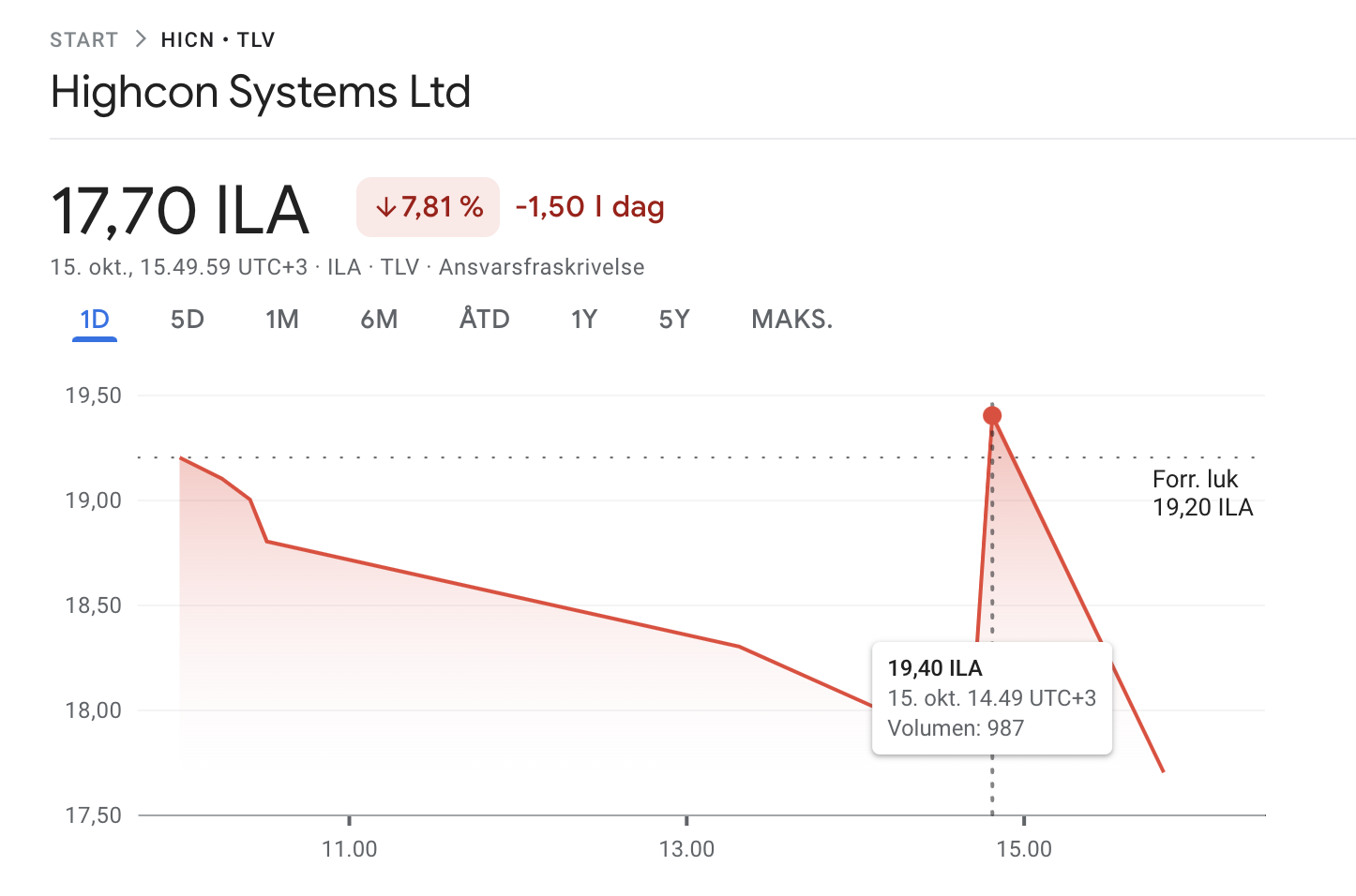

I was even more surprised this morning, Sunday, October 15th, as Google Finance indicated that the share was traded with a volume of 987,000 vs. an average volume of about 300,000 - or days even in the two digits. When radical changes in trading patterns appear, it's often because of press releases, statements, financial reports, etc. Still, I couldn't find any reporting on any channel, so I wondered if rumors about some salvation plan for Highcon had begun.

My colleague Henrik Klem Lassen, CEO with a background as an investor, and I researched a bit further, and from the Tel Aviv Stock Exchange, the share's closing price was the same as on Google Finance. Still, there was no indication of unusual trading patterns. For publicly traded companies they are obligated by law to publish information that can influence the share price to all shareholders and the public simultaneously.

The Highcon Website has been under maintenance for some time - and way longer than acceptable for a publicly traded company, so it's challenging to get information, as no press releases have been issued for a while. However, on the Tel Aviv Stock Exchange website, we found the information that a postponed General Meeting takes place on Wednesday, October 18th, at 5 pm. We have asked for an agenda, but no response so far!

The financial situation for Highcon is undoubtedly critical, and the options as we see it are that existing shareholders invest considerably in Highcon and bring further fresh capital to the company.

We don't think it will be easy to attract new investors on the current regime, so the other option is selling Highcon to a company with the resources to continue the R&D, service, sales, etc., for a fresh start!

A fresh start - a new company, valued rightly, with the right financial basis for ensuring the new - whatever - product they may have, and ensure a sales, marketing, and management that can do what the current haven't been able to.

Highcon has, according to its presentations, spent a lot of money on R&D, and I believe a breakthrough could be around the corner. In the current situation, I don't think they have enough money to finish the R&D and bring a new product or even products to the market - therefore, 'The Chicken or the Egg' headline. Nobody will invest in Highcon equipment with this uncertainty, and the only that can save Highcon is revenue - a growing revenue. A new investor could give customers faith in the future of Highcon and/or its Digital Finishing Technology and save millions of dollars in R&D, patents, current operations, customers, etc.

Remember, most of the revenue MUST come from sales of machines - it's not like an Indigo, where you have a constant recurring revenue for the lifetime of the Indigo. You must sell Highcons all the time!

But who could be interested?

Will Landa Ventures and JVP, as the significant investors, bring more money to the table? They are the only ones who know what's in the pipeline and should be interested in securing their current investment. On the other hand, I am uncertain about this - they may have the money, but they have not made the expected turnaround since Aviv Ratzman and Michael Zimmer left the company, so maybe a new ownership is needed?

Even before the IPO, Landa invested in Highcon, so maybe that source has been emptied?

Who else could be interested? It's not easy to point in specific directions. As an Israeli company, a guess could be other Israeli companies in the industry. But looking at Scodix, Landa, and HP as the biggest ones, I can't see any of them taking that step in that direction. I could see Highcon as part of one or two of the larger digitally-focused finishing OEMs, but the Israeli business culture is maybe just so much different that this wouldn't work - but who knows? :-)

These are exciting times, and Wednesday the 18th, I believe, will be a turning point for Highcon. Something has to happen; the longer it takes before the right actions are taken, the more difficult it will be. To my friends at Highcon - it must not be easy to see how things have developed in the past years - but you have great technology and will get there with the right effort and leadership!

-- INKISH HIGHCON RELATED FILMS --

Gafs Kartong - Lasse Svärd - Sweden

Autajon/Haubtmann - Xavier Boutevillain - France

Bennett Graphics - Adam Seiz - USA

Alon Bar-Shany - After HP - Israel

Fespa - Eitan Varon & Limor Elias - Israel

Virtual Packaging - Mike Ferrari, Matt Bennett & Monty Patterson - USA

Highcon - Aviv Ratzman - USA

Cartonnage du Château - Marc Royer - France

Highcon - Boris Bogdanovski - Canada

Tue October 15th

• vigc “ het congres “ ...

VIGC celebrates 25 years of passion and innovation in the Benelux graphic sector.

Fri October 11th

Pack-smart inc. to show...

Pack-Smart will showcase its Delta-X Track and Trace solutions at Pack Expo International 2024 on Booth #W-16075

Emt international welco...

Pecoraro resides in Minnesota and is covering the upper Midwest, West, and Southwest areas of the United States.

Thu September 19th

Hiflow solutions unveil...

HiFlow demonstrates its new tools for label converters and flexo companies

Wed September 18th

Ultimate tech unveils g...

September 4, 2024 – Ultimate Tech announced collaboration with GMG Color

Sun September 15th

Global graphics softwar...

Global Graphics Software and Mark Andy extend partnership to integrate SmartDFE into Digital Series HD press

Thu September 12th

Global graphics softwar...

Global Graphics Software and Dantex announce partnership to integrate SmartDFE into Pico range of UV digital presses

Tue September 10th

New printvis release: e...

New release out this week

Tue September 3rd

Emt international demon...

EMT International is returning to PRINTING United Expo with an end-to-end direct mail digital finishing line on booth C2731, September 10-12

Emt international chame...

EMT International announces its Chameleon RFX roll-to-roll rewinders and unwinders web widths are now designed standard at 23” (584mm).

Subscribe

Subscribe to our INKISH newsletter

Login

New User? Signup

Reset Password

Signup

Existing User? Login here

Login here

Reset Password

Please enter your registered email address. You will recieve a link to reset your password via email.

New User? Signup